A Con's Piracy Playbook-Part Two

The CLUB

The ‘wealth magnets’ created by 19th and 20th-century tycoons may be broken down into these primary categories: Finance/Banking; the Steel Industry; Petroleum production; and Transportation.

Recap from Part One:

The most powerful American Oligarchs during the start of the 20th century were— Cornelius Vanderbilt, John D. Rockefeller(JDR), J.P. Morgan, Andrew Carnegie, and Henry Ford. The cover story for all pirates may be entitled, “Private Enterprise.” The most familiar adjectives used to whitewash the mechanics of the insider deals are: Enterprising, entrepreneurial, maverick, individualist, and iconoclast. Used in a sentence: “He was a most enterprising individualist who broke all the rules.” In other words, everybody loves a winner who beats the odds. Lesson: Bend the rules when it is most advantageous.

From Shipping to Railroads to Kerosene/Oil Transport—The Financial Boom!

In the chapter on railroad transport, Cornelius Vanderbilt (1794-1877) is considered one of the primary kingpins of that particular empire. If you have yet to visit Vanderbilt’s Biltmore estate in Asheville, North Carolina —now a tourist attraction— I highly recommend witnessing how the dukes of the Gilded Age lived. It’s a spectacle of decadent opulence and excess—and yet, very beautiful to behold. The craftsmanship on display in the Biltmore estate is also evidence of architects, carpenters, and artisans who were highly skilled and dedicated to their respective crafts. [the Biltmore estate was used in the movie,“Being There.”] In our current age of the virtual dream (or nightmare) how many master craftsmen are apprenticing with able mentors and preserving the skills required to build anything resembling the Biltmore mansion of yesteryear? Perhaps I’m going off track, however, I do think the digression is worthy of deeper consideration. An individual’s self-reliance and dedicated skill set, or trade, have become quaint trifles as the techno-juggernaut increases with lightspeed.

Vanderbilt had the visionary sense to see that Railroads were going to quickly outpace interstate shipping on the US continent. Cornelius Vanderbilt (nicknamed “the Commodore” in reference to his boat piloting days) sold his fleet of ships and invested in the Railroad—which turned out to be a winning decision. The railroad revolutionized the transport of everything from cotton to crude oil to people. Moving products and people is still a profitable business model today. Consider how the landscape has changed over the last 10 years with the arrival of Bezos’ Amazon delivery trucks. Lately, I see more Amazon delivery trucks on the road than UPS trucks.

In the age of railway expansion, the Commodore recognized an opportunity to contract with JDR for the exclusive rights of shipping raw crude and kerosene throughout the nation. It was a win/win for both men and solidified JDR’s financial foundation. Consider the parallels between Amazon delivery trucks and the railroad’s role in providing products for Americans. It’s notable that in today’s consumer economy that plastic products made in China still require diesel powered trucks in order to complete the sale. [Plastic production requires petroleum as well] Even if the Amazon truck fleet is an electric/gas hybrid—the trucks still require tires. This is where the rubber meets the road in a financial sense—rubber for tires is coming from overseas and requires ships that require fuel for delivery. And anyhow—most tires are now manufactured where exactly? …

“The 5 largest exporters of new rubber tires are mainland China, Thailand, Germany, Japan and the United States of America. Collectively, that powerful quintet of suppliers sold 44.1% of the total value for all new rubber tires exported during 2021.”—https://www.worldstopexports.com/rubber-tires-exports-country/

The entire cycle of production-transport-sales is reliant on energy/fuel in order to work. ‘No fuel’ means ‘no profit’…unless life is lived in a digital universe where we own nothing and breathing air becomes obsolete. There’s that annoying WEF’er angle yet again.

The next phase of product transport(in the real material paradigm) was proposed some years ago: goods delivered via drones. This is where the Jetson’s version of the future enters: SMART cities coordinated via AI —every aspect of day-to-day human life as an automated bot realm(and the probable SNAFU hellscape which results—what could possibly go wrong?)

The Past Informs The Future: Creating a Monopoly

Some aspects of JD Rockefeller’s persona might’ve been conjured during Daniel Day Lewis’s tour de force role in the film, “There Will Be Blood.” The story is loosely based on Upton Sinclair’s novel, “Oil.” In the notes on the film’s script (written and directed by Paul Thomas Anderson), another entrepreneur—American oil tycoon Edward Doheny— is cited as the basis for Lewis’s character, ‘Daniel Plainview.’ However, we know for a fact that J.D. Rockefeller sabotaged his rival’s oil rigs—which may be considered pirate thuggery. Daniel Plainview also behaved as a thug when it was necessary in order to gain the winning advantage. Thus, there are similarities between Plainview’s ambitions and a young enterprising J.D. Rockefeller. Regardless of comparisons between the real JDR and the fictional Plainview, the “winning formula” remains a desirable character trait when it comes down to playing the capitalist game.

Daniel Plainview’s defining persona characteristic was exemplified as an antagonistic philosophical struggle between his materialist stoicism and the preacher, Eli Sunday’s humble, albeit needy faith. In the film’s character drama between the two camps (secular vs religious), depicted as old-time religion vs industrial aspiration, the preacher needs Daniel Plainview’s financial support in order to build a church; and Plainview sees an opportunity to use the church as a bargaining chip in gaining drilling rights on the parish families’ land—aka, pirate tactics or, ‘the long con.’

Whereas, the con-artistry found in J.D. Rockefeller’s historical example had to do with cultivating allies that would ensure that his monopolistic aspirations would materialize. The similarities are nonetheless apparent: dangle the carrot on the stick in order to gain a decisive advantage.

Initially, JDR’s “Standard Oil” empire was built upon the need for kerosene as a fuel source for lamps. Light was a significant factor with regard to the industrial expansion of American businesses as well as a tool for small farmers, as well as a utilitarian household comfort. Later, Thomas Edison and Nikola Tesla would pose a threat to JDR’s kerosene-lighting franchise. Thus, the arrival of Henry Ford was a timely alliance in supporting the creation of JDR’s most ambitious energy monopoly yet!

The byproduct produced after distilling the crude oil into kerosene is what we call “gasoline” today. The marketing genius was in understanding how a new fuel source could be derived from crude oil and become even more profitable. In discovering how a volatile petroleum product could be used as a new fuel source, the next character needed was the man who needed gasoline to run his automobile’s combustion engines. JDR gave Henry Ford five million dollars (that Ford needed in order to expand his factory) in order to commit to the gasoline-powered engine(rather than use ethanol as fuel), and this would further ensure that Standard Oil would become the primary provider of the nation’s fuel supply. “Fill’er up!”

Convincing any aspiring politician that gas stations would provide jobs and franchises across the vast American landscape was a cakewalk. Government regulations are most often a matter of profitability—thus, little concern was placed on details like chemical runoff and the polluting of the nation’s rivers as a result of gasoline distilleries. Not to mention urban blight and a lack of eco-friendly architectural integration.

Antitrust Laws

Later, Teddy Roosevelt decided that the Standard Oil monopoly needed to be broken up—even if Big Business was not undesirable in his political purview. However, after the break up of Standard Oil, JDR became a board member of the new petroleum company subsidiaries—thus ensuring that he still received a generous lion’s share of petrol profits. JDR went on to become even wealthier after the trust bust.

Businessmen might call this a brilliant strategy; and yet, the Darwinian misinterpretation— “Only the strong survive”—omits the detail that J.D. Rockefeller could not have become one of the wealthiest Oligarchs on the planet without the support of many millions of oil addicts. Create the addiction, and service the “needs” of the addict. This is the same profit model Pharma follows with the “pLandemic = vaxx sales” business platform. Once again illustrating why “piracy” is an apt term when reviewing the emergence of corporate Oligarchs as the rulers of the realm. For the record, I prefer the label, “OILGARCH” when referring to J.D. Rockefeller.

The Rocker-Felons

Standard Oil…suppressing alternative energy systems for over 100 years, and still counting!

Rockefeller funded the following: Universities, hospitals, and a variety of useful corporate foundations,i.e., the attributes of fertilizing a toxic indoctrination system. The medical establishment that was supported by Rockefeller philanthropy ensured a future business premise founded upon “sickness maintenance” and “disease capitalism”—rather than preventative medicine and a holistic health approach to ensuring a better standard of living— and the end of cancers created via the pollution created by unethical business practices and chemical compounds in our food chain. This is not to say that there haven’t been many doctors, surgeons, and nurses who were bound by the Hippocratic oath; however, when hospital administrators and money rule the roost in terms of exploring alternatives and treatments that are less profitable, we have witnessed major obstacles to authentic health-care practices. During the last three years(since 2020), we have seen the results of bureaucratic bottom lines which have little to do with sustaining healthy lives. I might call this: profits made on adversity—or victims for sale. It’s a variation on a “war economy.”

In conclusion, the philanthropic Rockefeller cover story masks how its foundation’s initiatives and agendas shaped the contemporary Medical establishment. The primary flaw in the business model has to do with the fact: a business that produces pollutants and pesticides that cause cancer and other diseases cannot simply fund a medical mafia and make up for a corporation’s lack of ethics.

“People before profit” is the bumper sticker dictum that summarizes the worker-class struggle throughout the world.

WHERE THE RUBBER MEETS THE ROAD

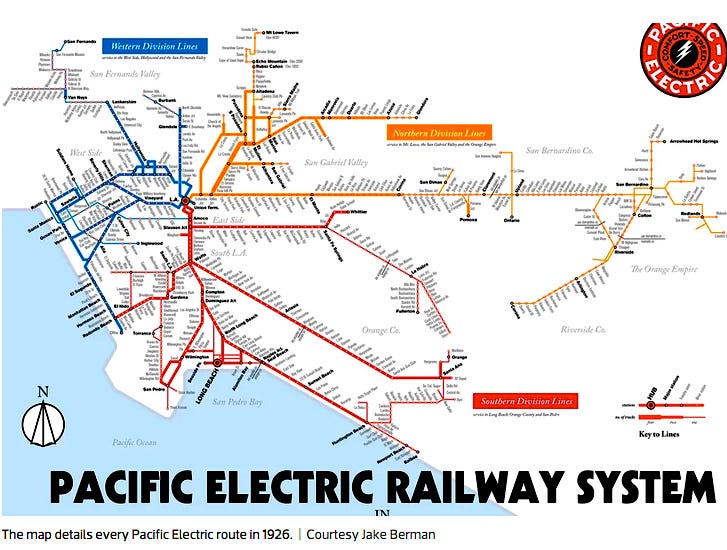

Firestone, GM and the Red Car Line story in L.A.—building on the success of Standard Oil’s business model

Trolley cars vs Buses…GM get’s a helping hand—ending functional mass transit in L.A. and selling a lot of tires and gas.

Trolley cars were efficient and accessible during the 1920’s and throughout the 1950’s. However, conflicts with the automobile and the growing numbers of drivers were considered a transit problem. Solution? …Make way for a gargantuan tire industry and give General Motors’ city bus division a marketing advantage,i.e., industrial expansion, and another guaranteed profit windfall. City governments would contract with GM to manufacture the nation’s municipal buses; illustrating the idea that capitalism incorporates a socialized funding source that benefits the Oligarch’s wealth pool. Automobile dealers could also see the profit margins on the horizon, and the sunny California weather was a real boon for convertible auto sales. After World War II, President Eisenhower also supported the expansion of the interstate highway system—and Southern California was on the roadmap for seven-lane highways. The automotive manufacturers knew that California represented tremendous market potential. The Red Line trolley system was destined for extinction and Firestone and GM were destined for greatness.

The Transit Con’s Piracy:

‘One company purchased and took over the transit systems of more than 25 American cities. The name of the consortium was National City Lines.’

The Guardian reports:

“…the list of their [National City Lines] investors included General Motors, the Firestone Tire and Rubber Company, Standard Oil of California, Phillips Petroleum, Mack Trucks, and other companies who stood to benefit much more from a future running on gasoline and rubber than on electricity and rails.”

“National City Lines acquired the Los Angeles Railway in 1945, and within 20 years diesel buses – or indeed private automobiles – would carry all the yellow cars’ former passengers.”

In 1947, the Federal District Court of Southern California— “…indicted nine corporations and seven individuals on counts of ‘conspiring to acquire control of a number of transit companies, forming a transportation monopoly’ and ‘conspiring to monopolize sales of buses and supplies to companies owned by National City Lines’ in violation of the 1890 Sherman Antitrust Act. The conviction came in 1949, with GM, Firestone, Standard Oil of California, Phillips Petroleum, and Mack Trucks found guilty and subsequently slapped on the wrists. (GM paid a fine of $5,000.)”

The FED Con’s Piracy:

The author of, “The Creature From Jekyll Island”—G. Edward Griffin states:

“It was in 1913 that Congress, in passing the “Federal Reserve Act” violated the U.S. Constitution and essentially granted its power to create money to the Fed banks. Since 1913, the fed has ordered the printing of currency and then loaned it back to the government charging interest. The government levies income taxes to, among other things, pay the interest on the debt.

So when you take a dollar out of your pocket, look at what it says at the top. This is a Federal Reserve Note, currency issued by the Federal Reserve Bank.

In 1964, that changed. President John F Kennedy issued an Executive Order, 11110. It gave the Treasury Department the explicit authority: “to issue silver certificates against any silver bullion, silver, or standard silver dollars in the Treasury.” This means that for every ounce of silver in the U.S. Treasury’s vault, the government could introduce new money into circulation based on the silver bullion physically held there.” And then, JFK was assassinated. Griffin continues, “After his assassination, The United States Note Project ceased.”

Bank note: Gold and silver were the currency valuation standard—until 1971.

Today—post ‘Bail Out’

In reality, many if not most of the successful capitalist entrepreneurs have relied on the Federal government for contracts—and this applies to the department of defense and military contractors in particular. As a recent example of capitalist cronyism, consider Elon Musk’s rise to Oligarchy status. The federal government relies on the citizen tax pool and the civilian workers who produce the material that the defense contractors need. This capitalist/socialist hybrid is indicative of ‘business as usual’ in terms of the MIC profit grid. Elon Musk represents the burgeoning technocracy’s marketing agenda in spades. The Space X corporation is yet one more intelligence agency within the DoD framework. Data is the new Oil—and Musk is one of the chosen oligarchs for the 21st century. The Musk/Tesla brand is poised to replace the Rockefeller legacy over the next 10-20 years. When the next generation becomes adults, they may not recognize Rockefeller’s legacy, much less understand why they’re chipped at birth. The JDR legacy that paved the way via a Standard Oil roadmap will just be more forgotten history and perceived as useless and unnecessary as the workers line up for jobs on Mars. Will we see a new distribution franchise emerge—such as ‘Wal-Mars?’

A Banker of great importance—JP Morgan

An intriguing footnote and precedent-setting example of corporate consolidation has to do with JP Morgan—the banker and financier and powerful 20th-century oligarch. Morgan was instrumental as a visionary conglomerate broker as he bought companies such as Carnegie Steel, and consolidated several of the biggest steel mills in order to form “U.S. Steel.” This consolidation model was replicated throughout the 20th century (and into the 21st century) with such notable examples as Gulf +Western/Paramount Pictures(1966); Sony/Columbia Pictures(1989); Bayer/Monsanto(2018); and Chase Manhattan Bank’s acquisition of JP Morgan to form ‘JP Morgan Chase’ in 2000. The 20th century also brought us slick new finance lingo as exemplified in the film “Wall Street”—directed by Oliver Stone, produced in 1987. Two of this films best-known details are the central character Gordon Gecko (as in: ‘lizard’) and his motto, “Greed is good.”

JD Rockefeller still remains the quintessential reptilian pirate in my review of the 19th and 20th centuries.

Gridlock

A.I. = ARTIFICIAL INSANITY

Additional Reading & Viewing:

https://ehistory.osu.edu/exhibitions/1912/trusts/roosevel

https://www.mercatus.org/economic-insights/expert-commentary/100-years-later-whats-become-our-federal-reserve

https://www.occupy.com/article/100-years-federal-reserve

https://www.technocracy.news/

https://www.studiobinder.com/blog/daniel-plainview-character-analysis/

https://www.goodreads.com/book/show/9716407-subversion-inc