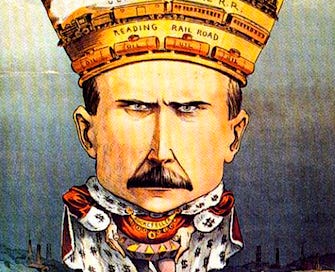

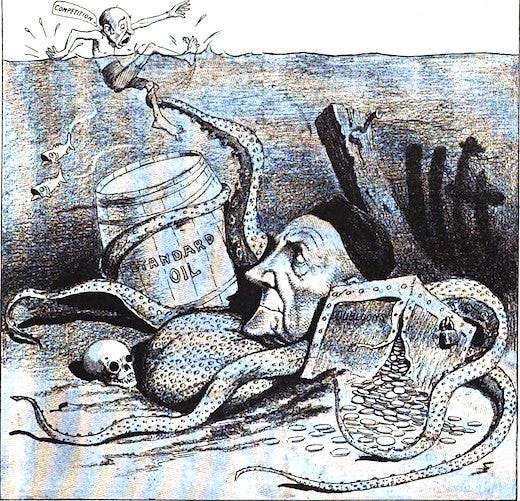

It’s difficult to decide where to begin when considering a panoply of the most stellar acts of piracy during the twentieth century. The best-known pirates are of course considered legitimate businessmen. These oligarchs were called Titans of American Industry. Due to the many assertions and presumptions regarding America’s exceptional expansion that began approximately 150 years ago, a detailed preamble is required in order to diffuse certain historical assumptions that are rendered as disingenuous attempts to glorify the legacy of cutthroat Billionaire-tycoons, aka “Pirates.”

The golden age during the latter part of the nineteenth century is known as the “Gilded Age” (from 1870-1900), and was a proving ground for several of the most formidable “Captains” of industry and finance. The primary cast of characters include Cornelius Vanderbilt, John D. Rockefeller, Andrew Carnegie, JP Morgan, and Henry Ford. These were the richest men in the world at the start of the 20th century. [note: The Gilded Age (1873), written by Mark Twain in collaboration with Charles Dudley Warner.]

Piracy or Enterprise?

When assessing the industrial twentieth-century business sectors we may easily break them down in terms of natural resources and labor. Energy production is the primary focal point for all of the most successful con’s piracies—creating the illusions of need(translation: a predictable profit schedule), rather than defining what is in actuality, a human necessity(translation: essential life support). This is where a discerning context proves invaluable when assessing how production and resource management are designed in order to provide benefits to the citizens who are labeled as “customers.” By the 1970’s the term— “customer” had morphed into “consumer.” We can see how Citizens who were once participants in the Republic’s development were later relegated to the role of unconscious consumer cogs in a profit matrix.

Consumption vs Necessity

The gimmick: those who control the production and distribution of vital resources control the marketplace. And those who control the marketplace become oligarchs. It’s a most enterprising endeavor to create a profit machine that appears as a wonderful thing for everyone, and yet—the nuanced contexts are the decisive consideration when reviewing the sum total of an industrial age. We see that Industrial expansion caused many problems in the wake of Oligarchy’s preeminence. The eventual emergence of corporate lobbyists sealed this nation’s fate and ensured that a corporate Oligarchy would prevail.

The conundrum for all who might support the libertarian ideals of free enterprise is a socialist/capitalist— ‘either/or’ battle for supremacy. The trouble with socialism is that when a central government—or centralized management hub imposes all manner of regulatory measures, these measures then become what is known as “red tape.” The interesting thing about red tape is that it applies to all the ‘isms’, whether capitalist-communist-socialist. Red tape usually benefits those with political connections more than support a fair market advantage for any new entrepreneurial wannabes. It’s as much a feudal lord situation as it is crony capitalism.

As an example of a 20th century financial wizard, consider Warren Buffett— who might be considered the equivalent of a modern-day Duke. In other words: a Duke is ‘lord of the land.’ Shake the right hands, follow the rules of the status quo, and wear a good looking suit. Does this sound like a cynical comment, or just a realistic observation about power and politics?

Mr Buffett has had quite a few advantages— generously awarded by our federal government.

“… Buffett used an analogy that any shareholder should understand. The Berkshire CEO characterized the federal government as an "owner" of a stake in Berkshire's earnings. As he described it, the interest that the government has entitles it to "dividends" -- in other words, tax payments -- proportional to the current corporate tax rate.

When the corporate tax rate was 35%, the value of the government's stake in Berkshire's profits was relatively high. Even with efforts to minimize the company's tax bill, Berkshire nevertheless paid billions of dollars each year to the IRS in taxes.

However, when lawmakers cut the corporate tax rate from 35% to 21%, it reduced the value of the federal government's claim on Berkshire's earnings. The 14-percentage-point reduction amounted to a 40% tax cut, and that means that 40% less of Berkshire's income was going to the government in the form of taxes. Conversely, that left a much larger share to go to regular investors.”-source: Motley Fool https://www.fool.com/investing/2019/02/26/warren-buffetts-big-gift-from-the-us-government.aspx

Ditto—a similar example is found with Amazon:

“Jeff Bezos has led Amazon to secure over a half of billion dollars in local incentives. State and local assistance are being used to subsidize constructing and expanding fulfillment facilities (allowing Prime-shipments to arrive faster).

“…the world's top three wealthiest men see the value in state and local assistance and are capitalizing on them.” -Inc. magazine

Bezos and Amazon couldn’t have acquired all the state and local support without the support of the consumers who wanted to get a deal and easy shipping arrangements. In effect, as taxpayers—the citizen/consumer paid for the products and then paid a second time when they boosted Bezos’s distribution empire through subsidies. This sort of scam is often called a smart business strategy. Piracy requires a certain amount of victimization in order to succeed. It might look cool in a Disney film when Jack Sparrow is ripping off the British government—but when a government is a purported democratic Republic—the pirates are ripping off the common folks.

— Pop Song Wisdom —

“Jammin’ Me” ~ by Tom Petty

“…Take back your insurance, Baby nothin’s guaranteed…”

Also of note—when insurance heavyweight—American International Group (AIG) failed in 2008 (due to credit default swaps and the real estate bubble burst) we Americans were on the hook for the tab, and the TARP Bail Out funds rescued the too-big-to-fail insurance company. In other words— a socialistic corporate welfare measure rescued AIG (to the tune of $180 Billion dollars). And Warren Buffet’s company Goldman Sachs(what doesn’t the man own?) was also bailed out— to the tune of $10 Billion US bucks. The misnomer, “making money” is more aptly, “taking money.” This is why I consider Buffett as another of history’s notable pirates.

Meantime, Buffett has pledged to give away his entire fortune to charitable causes, committing 85% of his wealth to the Bill & Melinda Gates Foundation. It appears that Bill Gates benefited greatly from being sent to Buffett for mentoring when Billy was still only a lad. It’s all just a matter of fate I suppose.

TARP defined:

“The Troubled Asset Relief Program (TARP) was an initiative created and run by the U.S. Treasury to stabilize the country’s financial system, restore economic growth, and mitigate foreclosures in the wake of the 2008 financial crisis. TARP sought to achieve these targets by purchasing troubled companies’ assets and stock.”—Investopedia

TARP footnote-

The Special Inspector General for TARP summary of the bailout says that the total commitment of government is $16.8 trillion dollars with the $4.6 trillion already paid out.”-Forbes, July 14th—2015

Social-ism

Socialism may also be defined as a form of collectivism, and in the best sense of sharing resources, this might be a worthy ideal. Except—for some reason, the same political interests that say they support the ideals associated with a people’s democracy still pay obeisance to the Central Bank, which turns out to be a global dictatorial administrator for a nation’s financial necessities. What we have seen in the US are forms of social welfare that have supported a corporate Oligarchy.

The conclusion? …Oligarchs like socialism, and why wouldn’t they?

LIFE SUPPORT & NECESSITY

As a definition for ‘necessary human life support’ I’ll use water as a profound example:

If the government was making certain that the people of this nation’s republic always had access to clean water, free to use as long as people managed the resource responsibly—then the government would operate as an oversight mechanism rather than a regulator that worked for the corporations making a profit on water distribution. This is what a municipal waterworks provides presumably, except for the fact that folks who rely on water for life support are usually paying a water bill. This is how capitalism works. We are taught from our childhood that there is no free lunch, and therefore we accept the ‘no free lunch’ trope as a fact of life. And yet…in another practical design construct—water is a basic fundamental of human life support—and therefore (like air) we must have access to water or we perish.

A layman’s guide to piracy—a dynamic resource:

“Free Lunch”…How the Wealthiest Americans Enrich Themselves at Government Expense (and Stick You with the Bill) publ. 2008

Free Lunch synopsis: “Johnston shows how, under the guise of deregulation, a whole new set of governmental regulations quietly went into effect—regulations that thwart competition, depress wages and reward misconduct. From how George W. Bush got rich off a tax increase to a $100 million taxpayer gift to Warren Buffett, Johnston puts a face on all the “dirty little tricks” that business and government pull. A lot of people are getting free lunches. However, there is no such thing as a free lunch. So who is paying the bill? You and me, the American taxpayer.”

In other words—the federal government via the crony capitalist construct allows pirates to prosper. Systemic corruption is made legal via regulatory and de-regulatory schemes. Recently we have seen how shaping the climate narrative can create many new revenue streams under a regulatory label: Environmental, social, and governance (ESG) which translates as an Investment protocol—and thus, a global economic “shaper.”[*profit scams to include burp masks for cows. Please see the RTT article that reports ‘taxing cow burps’ in New Zealand.]

David Cay Johnston: “I have no objection to that [getting rich] whatsoever. But get rich by working hard, working smarter, coming up with a better mousetrap. Don't get rich by getting the government to pass a law that sticks the government's hand into my pocket, takes money out of it, and gives it to you. That's not right. That's not a fair playing field.”

Excerpt from a Bill Moyers/ David Cay Johnston interview:

DAVID CAY JOHNSTON: He[Buffett] got a $665 million interest-free loan for the utility he has in the Midwest. Now--

BILL MOYERS: From? He got the loan from?

DAVID CAY JOHNSTON: From the taxpayers. Now, imagine for a moment that the house you live in today, you bought it 24 years ago and you agreed to pay the price then. And now you've got to pay back with no interest half the price in the dollars you agreed to in 1924. You could be rich just from that alone?

David Cay Johnston on Government: “…the Center for Responsive Politics reported in 2006 that about half of the Senate’s 100 members are millionaires and their average net worth is $8.9 million. Even those members of Congress who do not belong to the so-called “Millionaire’s Club” enjoy a host of congressional perks.”

The details regarding the Congressmen and women who are paid a six-figure salary, and then 10-20 years later become multi-millionaires, speaks volumes. I cite Elizabeth Warren as only one example. Warren’s worth has been estimated between $14 million and possibly upwards above $20 million.

An 18th century footnote…

When the United States of America was first conceived, there was no Federal Reserve Board managing US Treasury assets. An interesting footnote that I have yet to explore more fully to my satisfaction has to do with Alexander Hamilton’s campaign to create a central bank within the US government:

“Hamilton’s third report, the Report on a National Bank, which he submitted on December 14, 1790, advocated a national bank called the Bank of the United States and modeled after the Bank of England.”

What is more apropos than being an asset to central banking interests and later rewarded with a bank note bearing one’s own image?

In 1804, Alexander Hamilton (the Secretary of the Treasury) would die as a result of a gunshot wound received during a duel with a political rival, Aaron Burr(VP of the USA at the time). Shortly after the notorious duel, Thomas Jefferson removed Burr from the Democratic-Republican ticket due to Burr’s proposed actions to support Louisiana’s secession from the union. Burr wished to create a new country in Louisiana territory. Gore Vidal’s novel about Burr(aptly entitled:“BURR”) is still on my must-read-soon list. The reading list grows longer by the day even as the days seem to grow shorter.

The eighteenth-century ‘dueling rivals’ scenario conjures up images of pirates and profiteers in my romantic view of the period.

One particular riveting political battle has to do with Thomas Jefferson vs Alexander Hamilton regarding the arguments for and against a federal government’s central banking system. The arguments between Jefferson and Hamilton may be briefly defined: “Alexander Hamilton became a leading voice of the Federalists who believed that the federal government needed to be strong. On the other side, Thomas Jefferson, a Republican, argued that too much power in the hands of the federal government would lead to tyranny.” Jefferson’s concerns appear even more relevant today. President Washington would choose to support Hamilton’s arguments that were pro-National Bank—for better or worse: “Jefferson argued that the creation of a national bank was not a power granted under the enumerated powers, nor was it necessary and proper. Both gentlemen presented their arguments to Washington, and ultimately Washington agreed with Hamilton.” —source: https://www.gilderlehrman.org/history-resources/lesson-plan/battle-over-bank-hamilton-v-jefferson

Fast Forward…

What if the BANK was owned by ‘We the People’ instead of a handful of wealthy families who live in Europe? The contemporary notion of a Central Bank sounds more like a Monetary Monarchy than a friendly ‘Savings & Loan’ serving the citizens of local towns and villages; in effect—too much power is concentrated in too few hands,i.e., absolute power corrupts absolutely. Not to mention, a distinct disconnect between the local economies of scale here in the USA, and the ruling Lords of the Land on the other side of the ocean. How would a banking troll in Davos, Switzerland know what a small town in Pennsylvania requires?

The Revolutionary War was the new American government’s action in order to disengage from the British Monarchists’ tyranny in 1776-78, and then—again in 1812. Considering America’s legacy, this is an odd detail when one looks at the “Federal Reserve Act” passed into legislation and imposed upon the American people in 1913. Congress was on hiatus at the time and the bill passed easily. President Woodrow Wilson would never live down this infamous decision to support the Central bank’s authority here on US soil. Some believe Wilson had little choice in the matter—which is what I believe; i.e., Dark money and the Euro-Bankster Cabal’s coercion, in effect.

An example of a minor 21st century pirate…

S.Bankman-Fried qualifies as a pirate/con-artist, and villain of the moment. He’s actually just another scapegoat and diverts our attention from what is endemic within the entire global bankster construct. When most of the western banks are dealing in derivatives, this isn’t that far off from the FTX Ponzi. Listen to the Wall St expert interviewed in the documentary, “Inside Job”, when asked to explain what a “derivative” is—and he becomes tongue-tied. If an adult financial expert cannot explain a ‘financial instrument’ in simple terms so that a third-grader can understand—I suspect a snake oil ruse is going on. I label the entire Bankster-Pirate game as smoke & mirrors. It’s a rich man’s trick. Then again, without a participating audience, a magician cannot perform his magic.

The cover story for pirates of any era is subtitled, “Private Enterprise.” The most familiar adjectives used to legitimize the mechanics of the insider deals are Enterprising, entrepreneurial, maverick, individualist, and iconoclast. Used in a sentence: “He was a most enterprising individualist who broke all the rules.”

In other words, ‘everybody loves a winner who beats the odds.’ Bend the rules when it is most advantageous. White lies are harmless when there’s a profit in sight. Except that this construct renders life as a cheap Vegas card game. “Life as a game” promotes a profound imbalance in resource distribution. The lesson isn’t truly a capitalism vs communism problem—it’s more a matter of “paradigm” perception and a resulting definition that may be realistically considered obsolete.

Where ‘We’ are today vs where ‘They’ reside

The Nation reports:

“Bill Gates of Microsoft, Jeff Bezos of Amazon, and Warren Buffett control more wealth than the 160 million poorest Americans combined. And Buffett doesn’t mind working the system to keep it that way. His net worth as of January is $87 billion, but Buffett says he paid only $1.8 million in taxes in 2015—a mere 0.002 percent of his wealth. According to Barclays, the new Republican tax law is projected to net his business a staggering $37 billion.”

“We are called to be architects of the future, not its victims.”

~ R. Buckminster Fuller

~end part one…to be continued

It seems to me that you & Richard D. Wolff define "socialism" quite differently.

That last meme though! Priceless!