Two reports from two different sources, NTD and CNN—re: the US job market and employment statistics…

“There Are Three Kinds of Lies: Lies, Damned Lies, and Statistics”

…Ben Franklin’s image tarnished by FED shenanigans.

What Does ‘NTD’ Stand For?

NTD stands for New Tang Dynasty. The name is inspired by the noble legacy of the Tang Dynasty (618-907 C.E.), which is considered the golden age of Chinese spirituality and civilization. It was a time of peace, freedom, and openness. Admired the world over, the Tang Dynasty was known for its high moral standards and unparalleled cultural achievements.

NTD is a New York-based, global television network founded in 2001 by Chinese Americans who fled communism. They understood that independent media are crucial to a free society, so they created NTD to bring the world uncensored and truthful information—no matter the cost.”

I’m not endorsing news sources here, but feel it’s necessary to consider where the Mockingbird roosts, and where it may not yet have its talons embedded. We are at a precipice of a new realm, and we have to imagine a better world rather than succumb to victim-psychosis syndrome.

NTD reports on details that CNN seems to have adjusted in order to spin the stats in favor of the current admin and FED cronies. Just because there’s a surge in part-time employment doesn’t mean that some folks stop living in tents and campers! Food prices are still increasing by the week.

And rents are still not aligned with the ‘minimal wage’ cap.

NTD:

“Full-time employment levels plunged by 585,000 in July to 134.274 million. This was the largest monthly decline since the COVID crash, which saw 14.7 million full-time jobs vanish.

Part-time employment, which is defined as people who work less than 35 hours per week, skyrocketed last month.

Part-time jobs soared by 972,000 to 27.153 million.

“Moreover, the number of people employed part-time for economic reasons remained the same at 4 million.”

“This metric examines individuals who would have preferred full-time employment but have seen their hours slashed or cannot find full-time positions.”

While economists try to avoid focusing too much on a single data point, they assert that significant increases in part-time work typically occur in recessions. According to the Federal Reserve Bank of San Francisco, the rise in part-time employment results from a “cyclical reduction in labor demand that reduces hours worked along with increasing the unemployment rate.”

So, an upward trend in part-time employment levels can function as a recession indicator.

That said, part-time jobs remain slightly below the pre-pandemic level of 27.828 million.

Employment in temporary help services maintained its downward trend, falling 22,000 in July and is down by 205,000 since the March 2022 peak.

In recent months, market experts have weighed in on the general slide in temp jobs, warning that if the employment levels drop below 3 million, it could be something to worry about. Historically, a sizable decrease in this corner of the labor arena has typically occurred before recessions.”—NTD

Next up—CNN:

The US private sector added half a million jobs last month. Here’s what that means for Friday’s jobs report

By Alicia Wallace, CNN

Updated 5:13 PM EDT, Thu July 6, 2023

Minneapolis CNN —

US companies saw a massive, unexpected spike in hiring activity in June, according to private payroll processor ADP’s latest employment report, released Thursday morning.

ADP’s National Employment Report, produced in a collaboration with the Stanford Digital Economy Lab, showed that the private sector added 497,000 jobs last month, far exceeding economists’ expectations for 228,000 jobs and ADP’s May total of 267,000 hires.

While ADP’s tabulations don’t always correlate with the official federal jobs report, it’s sometimes viewed as a proxy for overall hiring activity. And by that measure, Thursday’s blockbuster jump is yet another indicator that when the June jobs report lands on Friday, it’s all but certain to show that the US labor market has added jobs for 30 consecutive months.”

In 2021, NYTimes reported 850,000 new jobs were added with an increase in wages. An increase in wages from $11-$15/hr perhaps? That still won’t pay the rent. Especially in New York City (slum living aside.) The job numbers mentioned in the NY Times report in 2021 seem very similar to the recent numbers of the reported upswing in part-time gigs in 2023.

On June 2, 2023, AP reported:

“US hiring jumped last month. So did unemployment.”

By Christopher Rugaber

Published 4:47 PM EDT, June 2, 2023

WASHINGTON (AP) — “The nation’s employers stepped up their hiring in May, adding a robust 339,000 jobs, well above expectations and evidence of enduring strength in an economy that the Federal Reserve is desperately trying to cool.

Friday’s report from the government reflected the job market’s resilience after more than a year of aggressive interest rate increases by the Fed.”

…This indicates that we are not in some magical economic upswing where the FED and its administrators may be lauded for a commendable performance. Monetary contractions, easements, and playing roulette with interest rates still won’t fix a broken Fiat Fiasco- Ponzi hat trick. It might be possible to validate the Wall St investment game using calculus, and yet this doesn’t translate as fewer mortgage defaults or fewer credit card defaults.

Even with the reported increase in job numbers and wage increases…

New York CNN reports:

Credit card and car loan delinquencies pass pre-Covid levels as consumers get squeezed

By Matt Egan, CNN

Updated 11:20 AM EDT, Thu August 10, 2023

“More Americans are failing to make payments on their credit cards and auto loans, another sign of rising financial pressure on consumers.

New credit card and auto loan delinquencies have now surpassed pre-Covid levels, according to a Wednesday report issued by Moody’s Investors Service.

The rate of new credit card delinquencies hit 7.2% in the second quarter, up from 6.5% in the first quarter, according to the Moody’s report, which was based on household debt data published earlier this week by the New York Federal Reserve.”

More jobs you say?…but wait—the average wages still don’t make it possible to make ends meet…

In 2008 we learned that Wall St Banksters could make profits on credit default swaps. Predatory capitalists- take note.

Moody’s:

“The good news from the Moody’s report is that fewer Americans are falling behind on their mortgage payments.”

you don’t say? …But wait, Moody’s predicts mortgage delinquencies in the next statement:

“New residential mortgage delinquencies have edged higher over the past year but remain well below pre-Covid levels. Moody’s doesn’t expect mortgage delinquencies to reach pre-pandemic levels until 2024.”—CNN

So which is it?

We’re led to believe that the job market indicates how well we may live, whether we can pay ‘the man’ his due (the Landlords, i.e., BANK), and this is an indicator of economic stability and some definition of “prosperity” based on what conditions exactly?

‘Awake in 3D’ listed the following areas of concern to add to the Voodoo Bidenomics menu above:

Soaring Housing Costs and the Burden on Homebuyers:

“Rising interest rates are contributing to a nearly 20 percent surge in monthly costs for new homebuyers compared to the previous year. This surge is straining the housing market, rendering it increasingly unaffordable for average citizens. The ballooning costs are pushing the economy towards a critical inflection point.”

Commercial Real Estate Mortgage Delinquency Surge:

“The surge in delinquency rates for commercial real estate mortgages is indicative of a looming catastrophe in the commercial real estate sector. This unprecedented spike points to an impending crisis, casting a shadow over one of the pillars of the modern economy.” [Below in the BlackRock segment we see that BR is buying warehouses]

Growing Financial Vulnerability and Lack of Emergency Funds:

“The increasing percentage of the population unable to cover a $400 emergency expense underlines the financial fragility faced by ordinary citizens. This lack of financial security is a symptom of deeper systemic issues within the fiat currency debt system.

These interconnected trends undeniably point to the fragility of the current global financial framework. The unsustainable nature of the fiat currency debt system is becoming increasingly apparent. To address this imminent crisis, an alternative system must be devised and implemented before the point of no return is reached.”—Awake in 3D

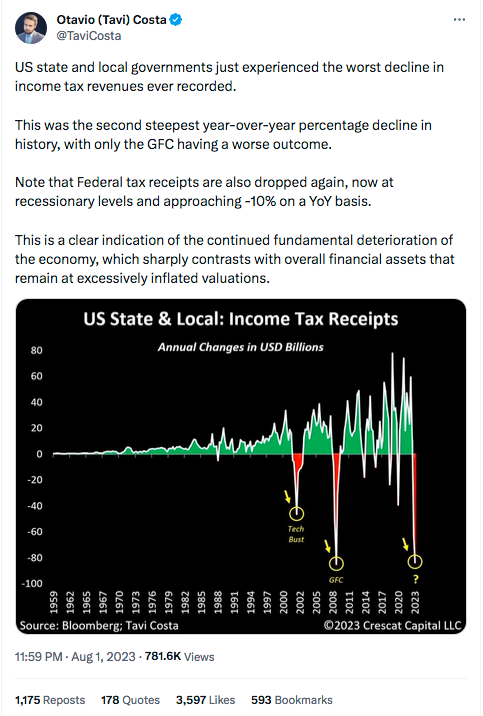

Another Reality checkpoint- income tax revenues in decline:

I say—all good re the end of the IRS income taxation program. Put a brake on the DC money laundering, and invest in the infrastructure and create a sustainable ecologically balanced local- ‘economy of scale’ program. The DC centralized bureaucrat model has failed most of Us in the serf class.

Let’s have a global debt jubilee and end slavery/usury once and for All. Of course, many finance writers and irate citizens might jump at the opportunity to blame the billionaire oligarchs and their corporations that never seem to pay their fair share of taxes… I see this as a moot point, and this is why:

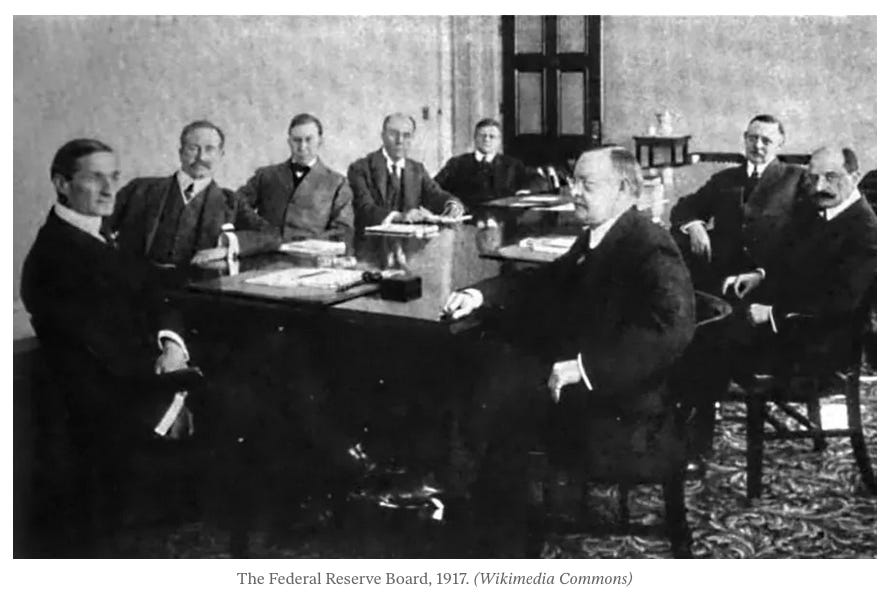

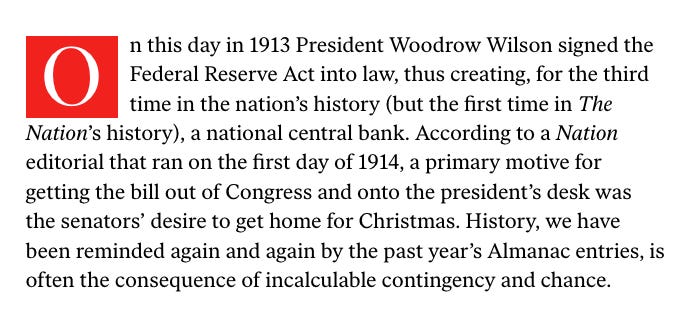

The IRS was created in tandem with the Federal Reserve Board in 1913 by a handful of corrupt bankers in cahoots with their cronies in congress—while most congressmen were on Christmas break. I am aware that I have repeated this detail often. The obvious conclusion is that we must not think that EuroBanksters and the FED care about our nation’s well-being. They are maintaining their centralized world order, and it’s not a pretty picture.

The FED cannot be expected to tell us the truth, nor present authentic solutions to the problems created by Fractional Reserve Banking and taxation without representation.

History Lesson

https://www.thenation.com/article/archive/december-23-1913-the-federal-reserve-is-created

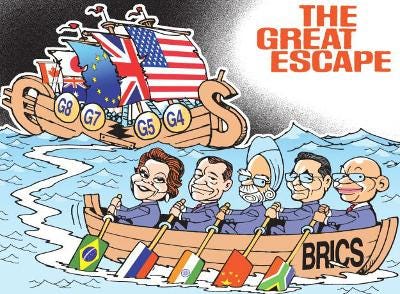

The MSM continues to avoid a critical analysis of the BRICS alliance’s long term effect on the US economy, and the value of the dollar.

The corporate media also handily avoids looking at BlackRock’s real estate portfolio—at least not with any far reaching look at how this affects the wee hobbit folk’s ability to buy food or own homes; or who will own most of America in the future.

“First on the list is its $4.4 billion acquisition of a collection of U.S. warehouses. This move was made in response to the rapid rise of e-commerce, which has led to increased demand for warehouse space. With this purchase, BlackRock now has a foothold in this growing market.”

BlackRock’s Recent Real Estate Purchases: A Closer Look

Key Points:

BlackRock has been expanding its real estate portfolio over the years.

The $4.4 billion acquisition of U.S. warehouses is in response to the rapid rise of e-commerce.

The Numbers Behind BlackRock’s Growing Real Estate Empire

—OCAOR Real Estate

What can we conclude from reviewing the voodoo of the present economic matrix?

Landlords and Oligarchs are representative of a feudal-technocracy in 2023. Not much different from how things worked 600 years ago. The attributes of communalism and an average serf’s access to capital are still reserved for the ruling class, or the chosen people. The upper class investors all play in the same sandbox while the serf class looks on from the sidelines and feels the pinch of inflation.

We the People need a real Monetary Reset that will level the playing field and forgive all indebtedness. We need to start with a fresh slate sans centralized BANKs, and without absurd scripted political duopoly narratives covered by corporate media buffoons.

And… I’d like to see the label “Economist” erased from the daily political dialog altogether, maybe say it’s a ‘Hate Speech’ thang.

Agreed, i seriously doubt the gold standard Sans CBDC nonsense can get us out of this mess. Ive lost complete faith in the 2 party democratic BS. There's always been rulers, there's always been the ruled worker class. Is there even a true working class anymore? People are so cognitive dissident, just either struggling to make it or content w their position and fearful of any change of status. Ive lost faith in the republic I gave body parts for. Im dug in, rural, skilled and as prepared as i can be. My biggest fear is the youth of this nation. SHINE ON.